Christianson Health Brokers LLC

HAVE A QUESTION?

Don’t let the complexities of Medicare overwhelm you. Contact Christianson to take the first step towards securing the right coverage!

Medicare Supplements, Advantage plans, and Part D Prescription Drug plans

If you are currently enrolled in Medicare but find yourself uncertain about whether a Medigap plan or Medicare Advantage plan would be more suitable for your needs, Christianson Health Brokers is here to help! Here’s a comprehensive breakdown of both options, enabling you to make a well-informed decision regarding your Medicare coverage.

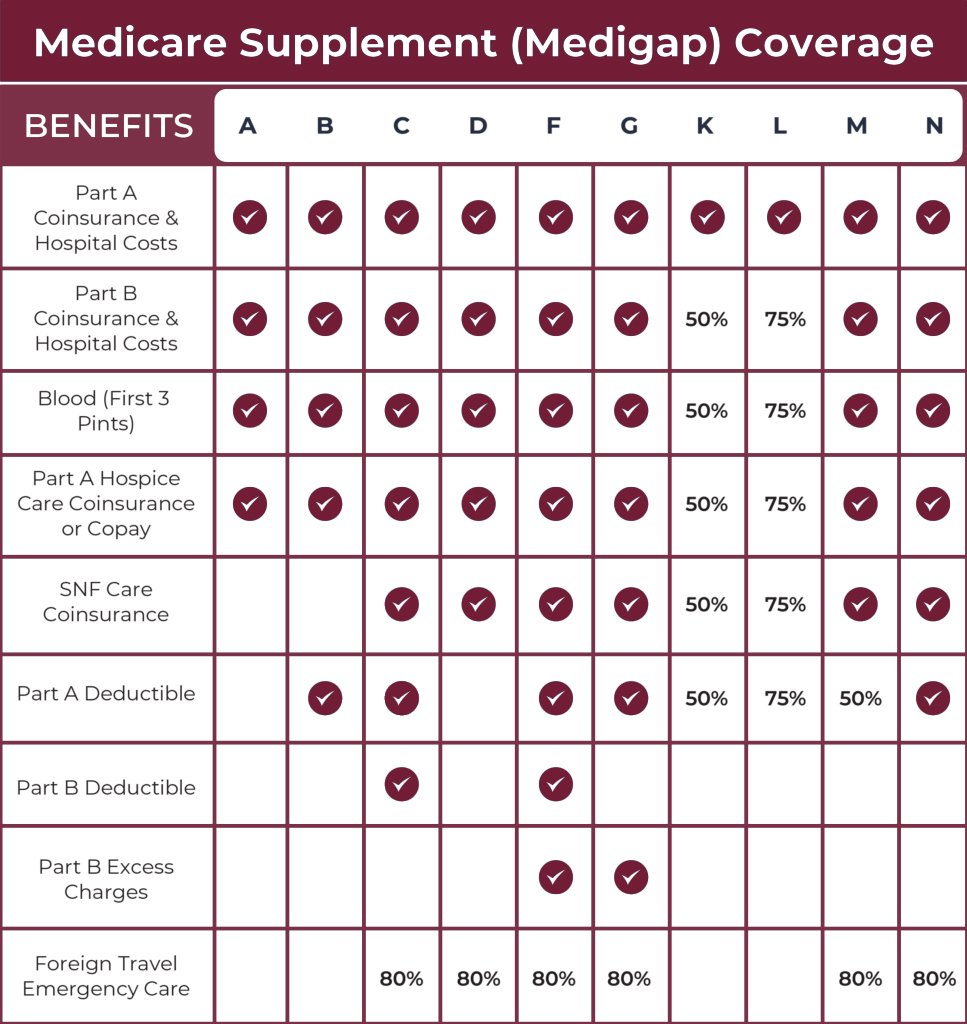

WHAT DOES MEDIGAP COVER?

There are various Medicare supplement plans available that can supplement your Original Medicare (Part A and B) coverage. The type of Medigap plan that is right for you will ultimately be based on the type of coverage you are searching for. Below is a breakdown of what each Medigap plan covers:

What do Medicare Part D drug plans cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes, like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a formulary, and each plan has its own formulary. Medicare drug coverage typically places drugs into different levels, called tiers,

on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

The cost of a one-month supply of each Part D-covered insulin is capped at $35 and you don’t have to pay a deductible. If you get a 60 or 90 day supply of insulin, your costs can’t be more than $35 for each month’s supply of each covered insulin.

WHAT IS MEDICARE ADVANTAGE?

While Medigap is a supplemental option for Original Medicare coverage, Medicare Advantage (Part C) plans are recognized as alternatives to Original Medicare. Medicare Advantage plans must adhere to Medicare’s regulations, ensuring they offer at least the same coverage as Original Medicare. However, some Medicare Advantage plans may provide additional benefits, such as dental, hearing, vision, and prescription drug coverage. The Medicare Advantage plan available to you will depend on your eligibility and location. Here are the most common types of plans available:

HEALTH MAINTENANCE ORGANIZATION (HMO) PLANS

HMOs are usually cheaper than other Medicare Advantage plans. They require plan members to use their in-network providers and choose a primary care doctor.

PREFERRED PROVIDER ORGANIZATION (PPO) PLANS

PPOs offer more flexibility. You can use out-of-network providers but at a higher cost. Plan members don’t have to choose a primary care doctor or get referrals to see specialists.

SPECIAL NEEDS PLAN (SNP)

SNPs are for those who are Dual eligible for Medicare and Medicaid (D-SNP), have chronic and disabling conditions (C-SNP), or are living in an institution (I-SNP).

PRIVATE FEE-FOR-SERVICE (PFFS) PLANS

PFFS plans negotiate what you will pay and what they will pay for every visit, giving you the benefit of knowing what your costs will be beforehand. You can see any doctor who accepts the terms and conditions of your PFFS plan.

MEDICARE MEDICAL SAVINGS ACCOUNT (MSA)

MSA plans use a savings account and high deductible plan to pay for medical costs.

Medicare Supplements, Advantage plans, and Part D description drugs

If you are currently enrolled in Medicare but find yourself uncertain about whether a Medigap plan or Medicare Advantage plan would be more suitable for your needs, Christianson Health Brokers is here to help! Here’s a comprehensive breakdown of both options, enabling you to make a well-informed decision regarding your Medicare coverage.

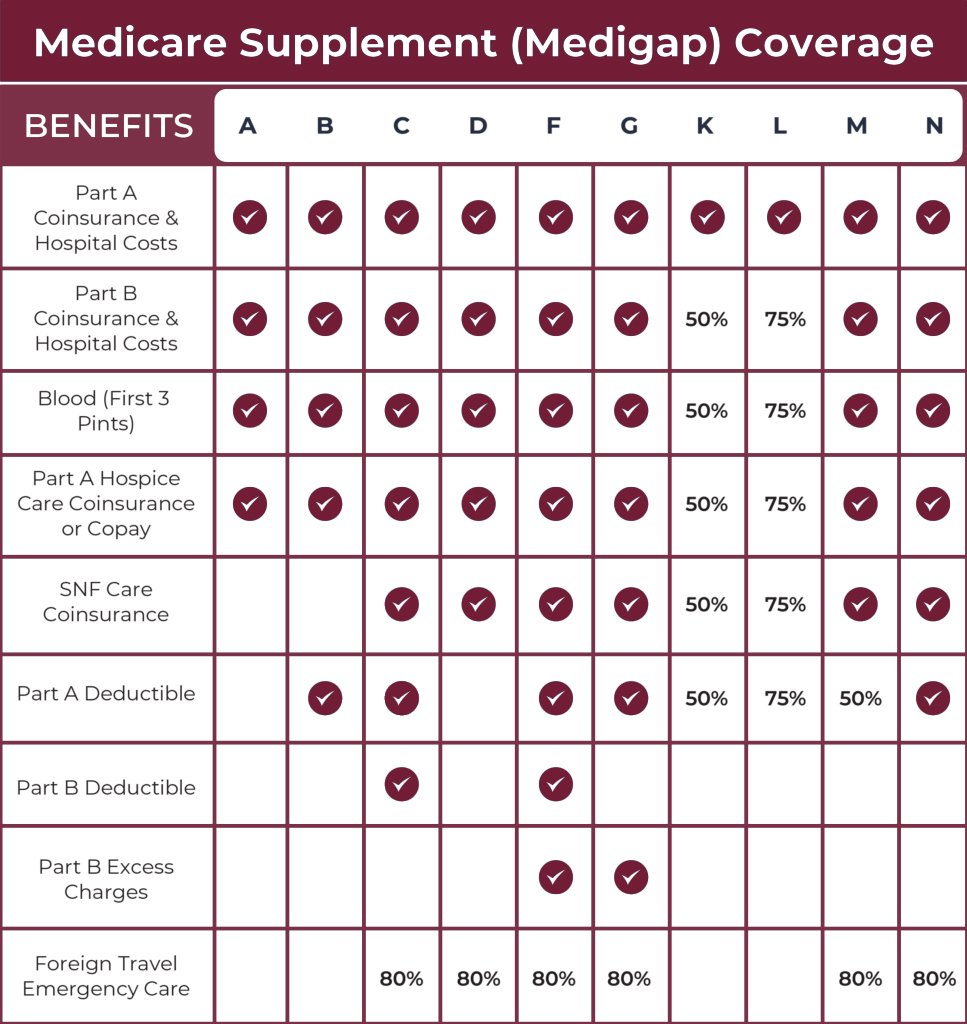

WHAT DOES MEDIGAP COVER?

There are various Medicare supplement plans available that can supplement your Original Medicare (Part A and B) coverage. The type of Medigap plan that is right for you will ultimately be based on the type of coverage you are searching for. Below is a breakdown of what each Medigap plan covers:

What Medicare Part D drug plans cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes, like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a formulary, and each plan has its own formulary. Medicare drug coverage typically places drugs into different levels, called tiers,

on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

The cost of a one-month supply of each Part D-covered insulin is capped at $35 and you don’t have to pay a deductible. If you get a 60 or 90 day supply of insulin, your costs can’t be more than $35 for each month’s supply of each covered insulin.

WHAT IS MEDICARE ADVANTAGE?

While Medigap is a supplemental option for Original Medicare coverage, Medicare Advantage (Part C) plans are recognized as alternatives to Original Medicare. Medicare Advantage plans must adhere to Medicare’s regulations, ensuring they offer at least the same coverage as Original Medicare. However, some Medicare Advantage plans may provide additional benefits, such as dental, hearing, vision, and prescription drug coverage. The Medicare Advantage plan available to you will depend on your eligibility and location. Here are the most common types of plans available:

HEALTH MAINTENANCE ORGANIZATION (HMO) PLANS

HMOs are usually cheaper than other Medicare Advantage plans. They require plan members to use their in-network providers and choose a primary care doctor.

PREFERRED PROVIDER ORGANIZATION (PPO) PLANS

PPOs offer more flexibility. You can use out-of-network providers but at a higher cost. Plan members don’t have to choose a primary care doctor or get referrals to see specialists.

SPECIAL NEEDS PLAN (SNP)

SNPs are for those who are Dual eligible for Medicare and Medicaid (D-SNP), have chronic and disabling conditions (C-SNP), or are living in an institution (I-SNP).

PRIVATE FEE-FOR-SERVICE (PFFS) PLANS

PFFS plans negotiate what you will pay and what they will pay for every visit, giving you the benefit of knowing what your costs will be beforehand. You can see any doctor who accepts the terms and conditions of your PFFS plan.

MEDICARE MEDICAL SAVINGS ACCOUNT (MSA)

MSA plans use a savings account and high deductible plan to pay for medical costs.